ETH Staking Overview

Introduction

Since September 22, 2022 the Ethereum protocol has fully transitioned from a Proof-of-Work to a Proof-of-Stake consensus mechanism. The implementation of a Proof-of-Stake consensus mechanism can vary widely depending on the different networks (see Polkadot staking). On Ethereum, staking is implemented via a Deposit smart contract and Validators. Staking is the act of depositing 32 ETH to the Deposit contract in order to activate a validator node. This will enable you to contribute to the security of the network, and to earn rewards.

The benefits of Ethereum staking are:

- High yield : Ethereum is the largest smart-contract blockchain by market cap and developer activity. However, only about 11% of the ETH supply is currently staked, in contrast with 50-80% on other PoS blockchains. This means that rewards are significant, and stakers should expect an APY of at least 5% under current market conditions. You can find more information on Ethereum staking rewards here .

- Low risk : so far, only 0.36% of validators have been slashed. Slashing is considered to be a rare event, and should only affect validators who misbehave deliberately. As long as the validator is participating for at least 50% of the time, they will not lose their stake.

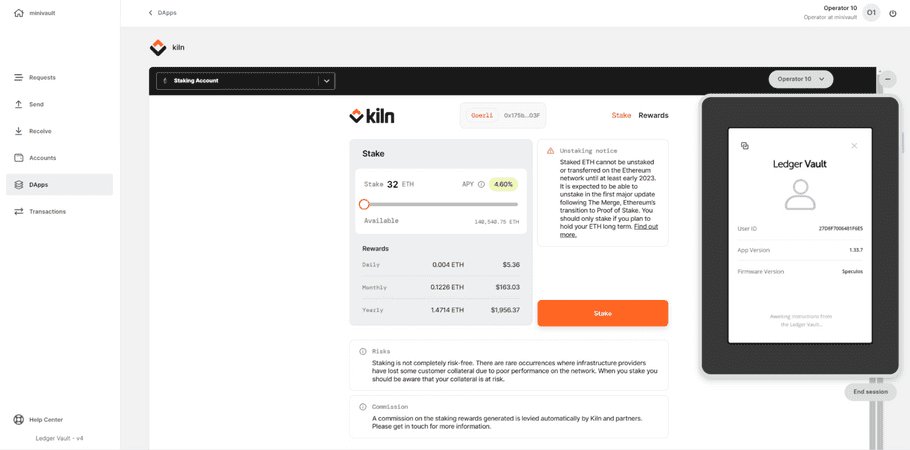

- Simplicity : unlike other networks where staking requires a more complex set up and a suite of operations, such as Polkadot, staking on Ethereum is straightforward and can be managed easily. Thanks to our unique staking offering in partnership with Kiln, Ledger Enterprise provides an easy-to-use, 2-click feature that lets you earn yield on your Ether while remaining in control of your assets and with security and peace of mind.

How does it work?

Overview of the different staking operations on Ethereum

Staking is the act of depositing 32 ETH to the staking deposit contract in order to contribute to the security of the network, and to earn Ether rewards in return (between 4 & 8% depending on network activity). Because the transition to a Proof-of-Stake consensus mechanism is phased, there is no withdrawal available until the deployment of the Shanghai upgrade (expected to take place in early 2023). This means that all staked Ethers are automatically locked/illiquid until the Shanghai upgrade.

In essence, there are three main operations involved when staking on Ethereum: depositing to activate the stake, withdrawing reward (partial withdrawing), and exiting to end the stake (full withdrawing). When staking via Ledger Enterprise, every interaction is managed and secured by your Ledger Vault to ensure self-custody and peace of mind. Only the Vault Ethereum account that initiated the stake can control it and receive the withdrawn funds at the end of the stake’s life cycle. All assets remain in custody of your Ledger Enterprise accounts.

Please note that a staking positions on Ethereum requires to be of at least 32 ETH to be valid; you can initiate multiple stakes at once by submitting any multiple of 32 ETH to save on gas.