Run Tradelink as an Administrator

How to Build Your Off-Exchange Trading Network

To get access to Ledger Tradelink, please contact our Client Success and Technical Account Managers to get onboarded.

Configure your network and setup roles

Below is a list of requirements you will need to provide to your Technical Account Manager before commencing the Tradelink onboarding process. These will be used to pre-load information onto your workspace about each previously mentioned role. Each participant of the Network will need to define a Group of Operators and Whitelist Addresses. Once this information has been pre-loaded, the Administrator will be able to begin building the Off Exchange Trading Network. Please note that these groups and whitelists will not be editable until March 2025.

Custodian:

-

Operator Group - a list users of your workspace (Custodian staff members or API operators) who will be able to:

- Approve settlements

- Approve withdrawals

- Approve arbitrations

- Exchange Whitelists - which Tradelink Exchange’s you want to connect with on your network.

- Asset Manager Whitelists - which Asset Managers you want to appear on your network.

Asset Managers:

-

Operator Group - a list users of your workspace (Asset Manager staff members or API operators) who will be able to:

- Create pledge requests

- Create withdrawal requests

- Pre-approve settlements

-

Withdrawal Whitelists

- A predefined whitelist containing all the addresses for all the currencies that you want asset manager operators to be able to withdraw to.

Exchanges:

-

Operator Group - a list users of your workspace (Exchange API operators):

- Create settlement requests

- Approve pledge requests

- Create arbitration requests

-

Pledge/settlement Whitelists

- A predefined whitelist containing all the addresses for all the currencies that an exchange wants money to be able to settle to

Once this information is provided, you will be able to activate the Tradelink module on your Vault workspace.

Monitor Accounts

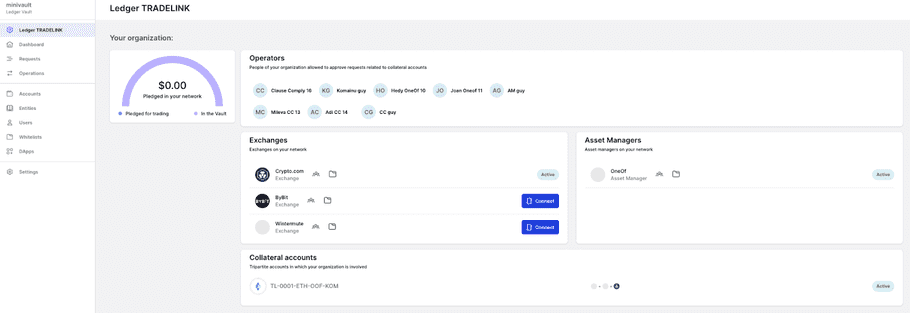

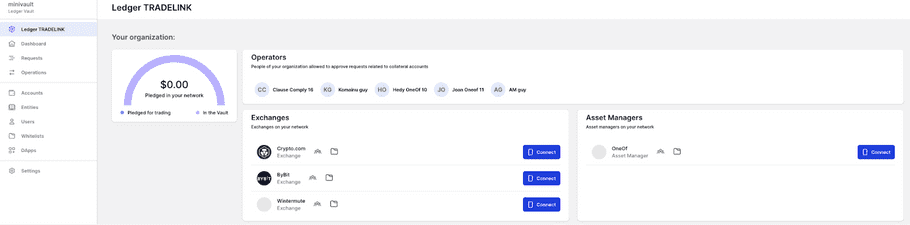

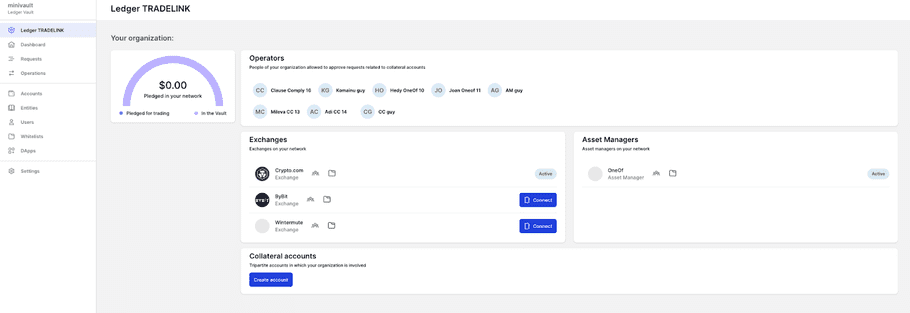

Ledger Tradelink dashboard will be available on the left hand menu of the Vault main page.

When selecting the Ledger Tradelink option, a dashboard will be displayed to the users (administrators). The dashboard will allow users to see available and pledged balances of the accounts and to control in one place all the Collateral Account statuses and active Operator Users for those accounts.

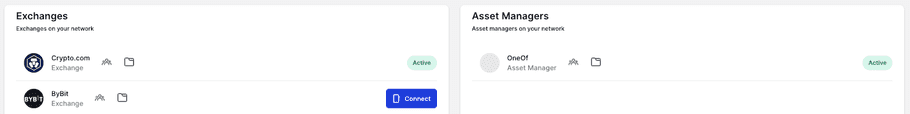

Connect Your Network

In the “Exchanges” block section, Administrator Users can begin connecting pre-loaded Exchanges and Asset Managers to their Tradelink network.

To do this, users will need to commence the connection flow by clicking “Connect” next to the relevant organisation.

Once this process has commenced, the Administrator User will see a pending state next to the relevant organisation.

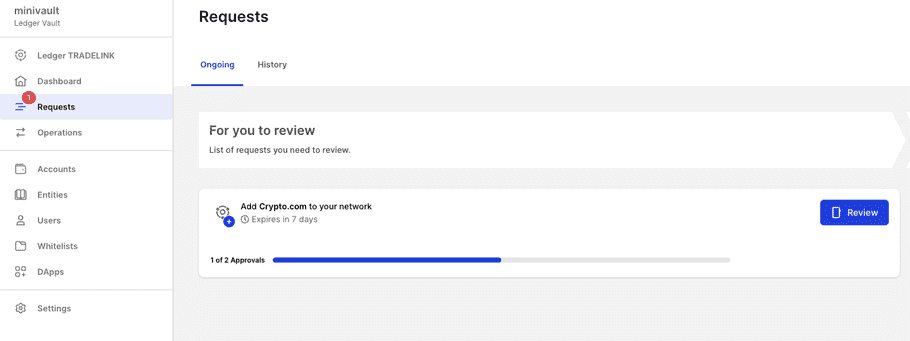

The Administrator User will then need to get approvals from other administrators from their organisation, as well as an operator from the counterparty (e.g. the Exchange or Asset Manager). The approvals will show up in the “Requests” tab of the Vault UI as shown below.

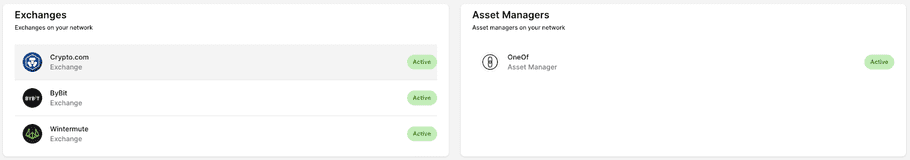

Once approved, the organisation will show as active in the Tradelink Dashboard.

Note: To start with Tradelink at least 1 Exchange and 1 Asset Manager must be set up as an API/UI operator and as a group on the platform.

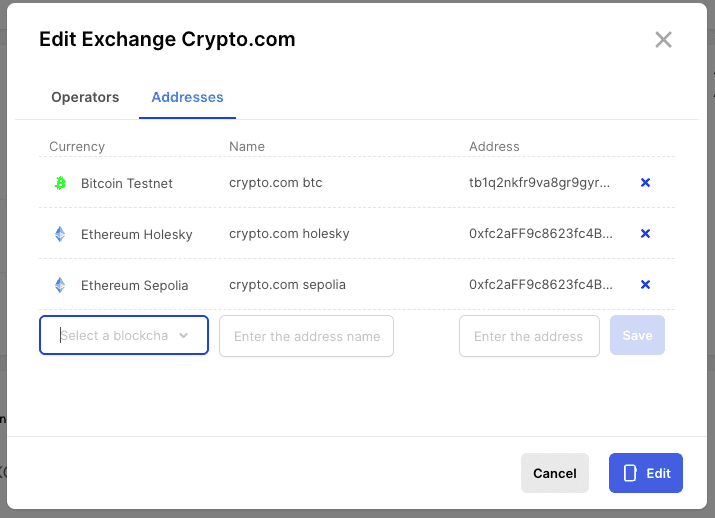

Edit your Network

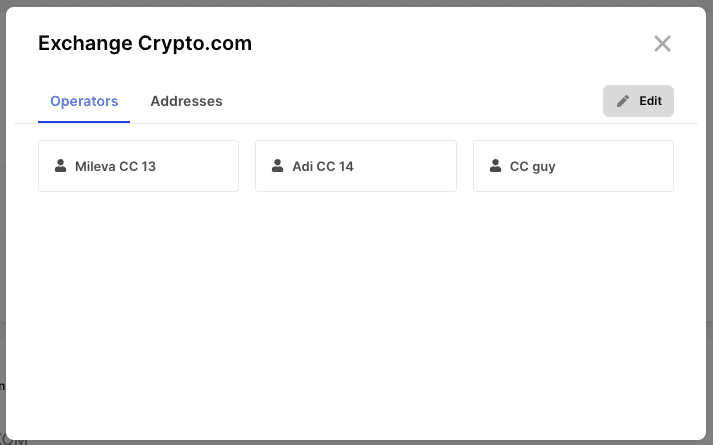

Once your network is connected, you can edit the users and addresses associated with the Exchanges and Asset Managers in your network. To do this, select the exchange or Asset Manager you’d like to edit.

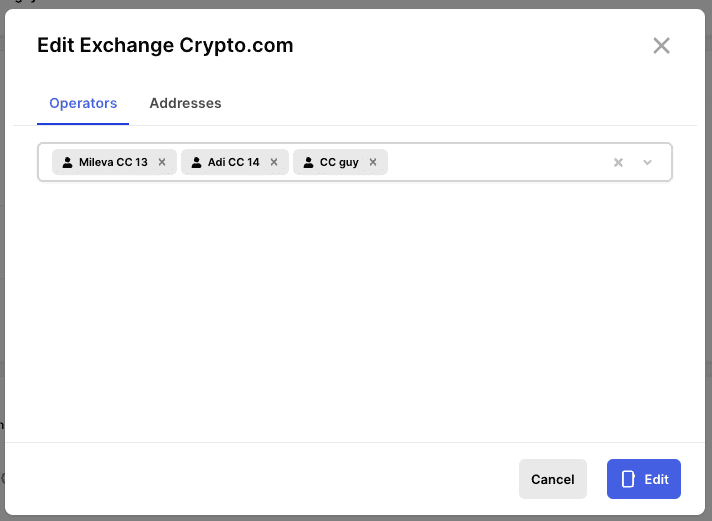

Once you have selected an option, a display modal will appear with the option to edit.

Click on edit to be taken through the flow. You will be able to add or remove Operators allowed to interact with this exchange and addresses that you would like to be whitelisted to this exchange.

Once edited, you need to confirm the new state of the exchange or asset manager with your PSD. Then, you will need approval from another administrator in your quorum. After this, the exchange or asset manager has been edited.

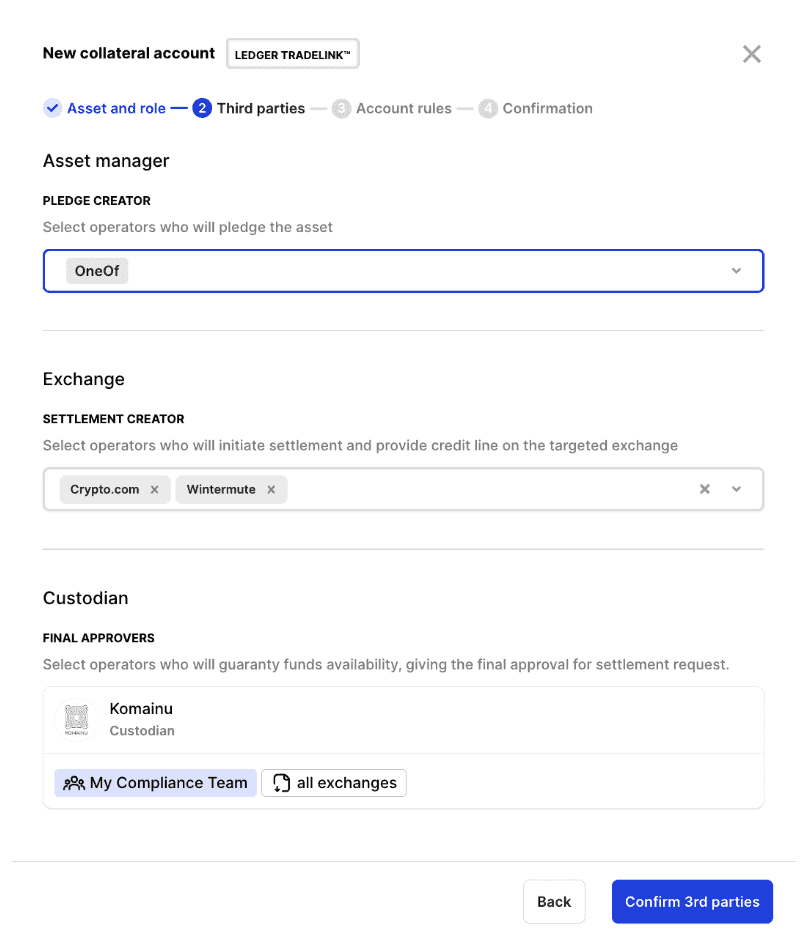

Create Collateral Account

Now the Custodian Administrator can proceed to create a Tradelink Collateral Account by selecting “Create Account” from the Tradelink account dashboard, or from the accounts page by selecting “Create collateral account”.

At this stage, previously defined groups must be assigned to the roles, with the possibility of being able to restrict the number of Exchanges you select for a specific account.

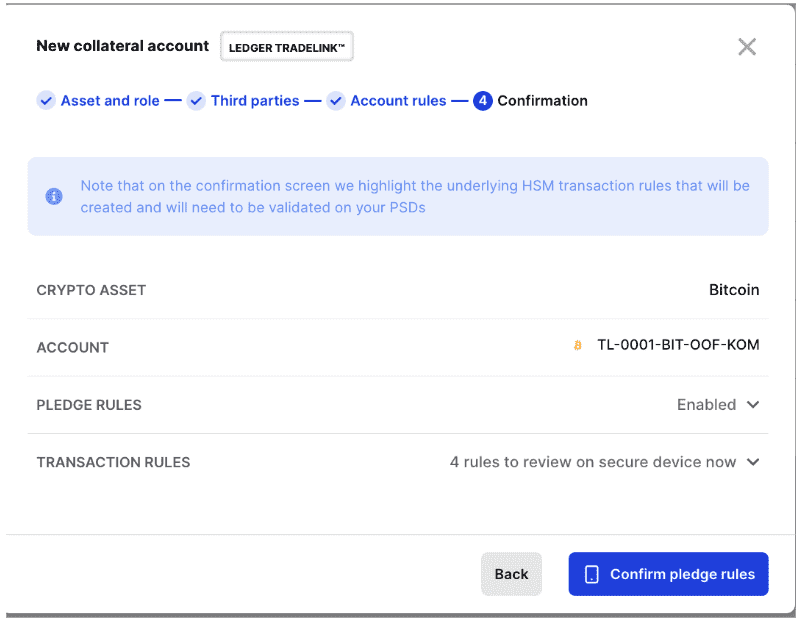

Once the roles are defined, the Administrator will need to confirm each of the four following rule sets that relate to the request types offered on the Tradelink service:

- Pledge Rules

- Settlement Rules

- Withdrawal Rules

- Arbitration Rules

These rules will be pre-populated with the creator’s and approver’s rights based on the groups selected during the initial assignment of group roles.

No additional configuration on governance rules is required except for the in Settlement rule.

Settlement Pre-approval Rule

The Settlement rule offers the option of adding a “pre-approval” step for the Asset Manager, and this will need to be enabled during the collateral account setup process. This is optional and set to be enabled by default. (Please note, the option to turn this off will be disabled until February 2025 due to account editing restrictions).

This option allows the Asset Manager (authorized group) to pre-approve a settlement request before the Custodian gives the final approval. There are several conditions where this could be required, for example:

- Custodian Risk Reduction: a Custodian might want to ensure an Asset Manager has reviewed and agreed to the terms of the settlement request before giving final approval.

- Exchange Risk Reduction: an Exchange might want to have a pre-approval from the Asset Manager before broadcasting a settlement transaction. This will not guarantee final approval from the Custodian but will give confidence to the Exchange that in the approval flow the Asset Manager already agreed on the terms of settlement and provided first approval, and now the risk is limited to the Custodian approval.

Automatic Re-pledge Rule

The Settlement rule also offers the option of adding a “automatic re-pledge” step for the Asset Manager and Exchange. This will need to be enabled during the collateral account setup process. This is optional and set to be disabled by default. An outline of the benefits of this rule can be found here.

As a custodian admin, you can configure automatic re-pledge requests when creating a collateral account:

- Toggle Option: During the collateral account creation flow, you have the option to toggle automatic re-pledge requests on or off.

- Exchange Selection: You can select which exchanges you would like this to apply to.

- Default Setting: The toggle for automatic re-pledge is turned on by default but can be overridden.

Edit Collateral Account

Collateral accounts can also be edited at any time after creation. There are 3 parts of the collateral account which can be edited. It is also important to note that an account cannot be edited if there is an operation occurring related to this account, such as a pledge or settlement.

Third Parties

In the third parties section of the collateral account editing flow, you can change the exchanges that are linked to this collateral account. Adding or removing exchanges will then impact the pledge and settlement rules on this account.

Account Rules

In the account rules section under Settlement, there are the two other parts that we can edit.

- The first is the Automatic Re-pledge rule which makes it possible for exchanges to pass a settlement to the account with a repledge intent specified.

- The second is the Settlement Pre-Approval rule, which adds the Asset Manager to the approval quorum of the settlement.

Final Confirmation

Once the Custodian Administrators have carefully reviewed each rule, they can proceed to confirm and approve the Collateral Account creation request on their Ledger device. There will also be a review required from the Asset Manager operator to approve this account.

Once approved by the administrator and operator quorum via their PSDs, the rules defined will be enforced by Ledger Enterprise HSM. It is important to note that until the Account Manager approves the account activation, the account will remain in a pending activation state. Once approved, the account will become active.